portability of estate tax exemption 2020

As you know the 2020 estate and gift tax exemption amount is 11580000 per person and as a result of this extremely high level very few people are subject to estate and. The surviving spouse would therefore be able to shield 228 million from the 40 federal estate tax when it passes to heirs upon death instead of 114 million.

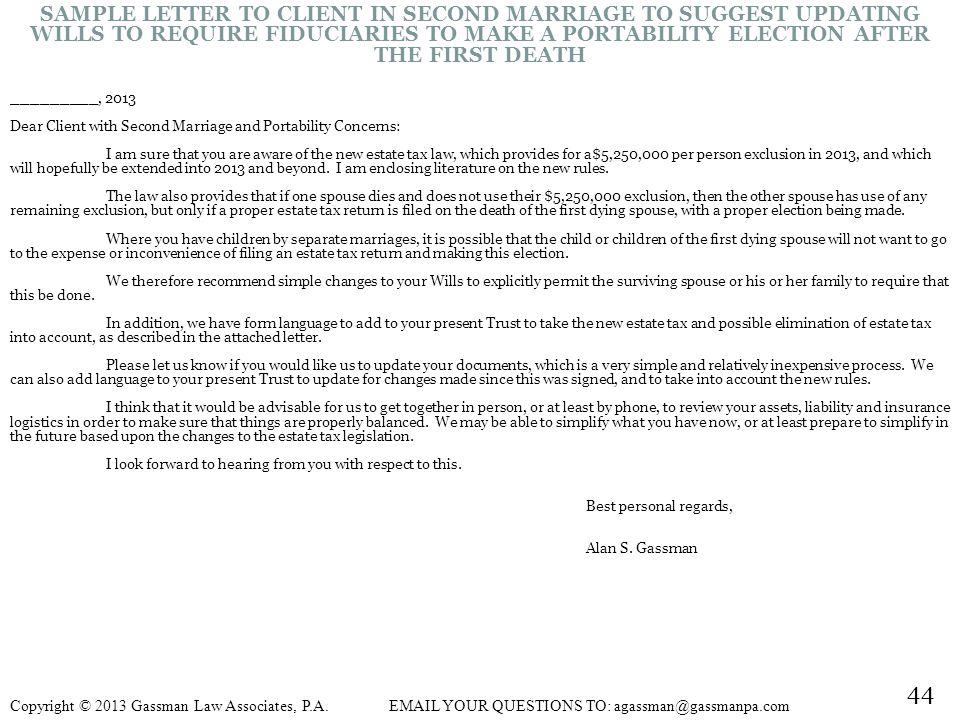

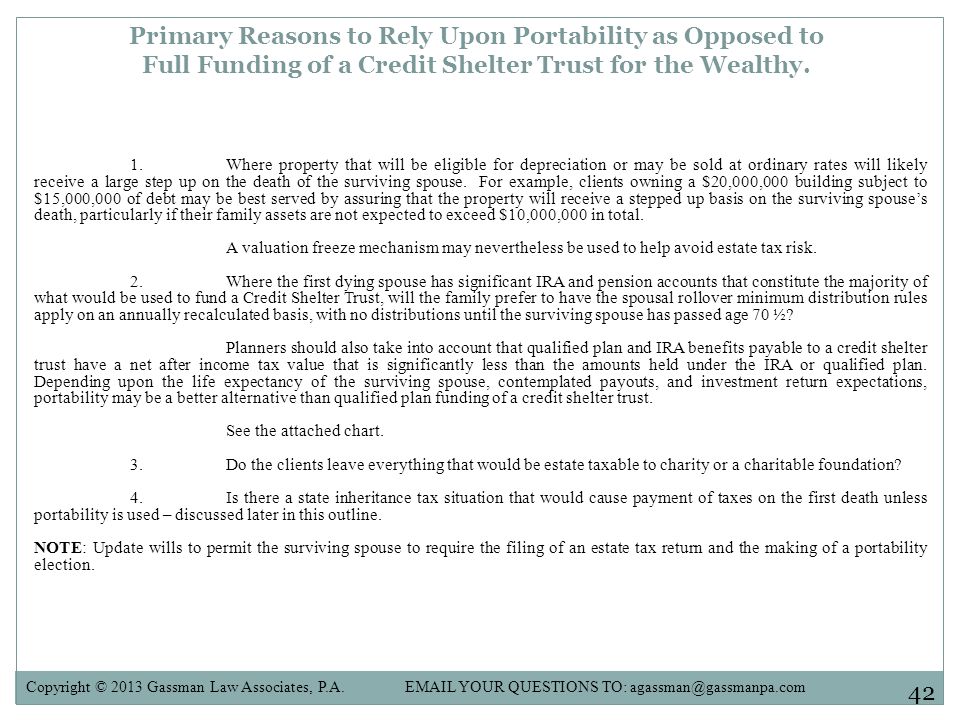

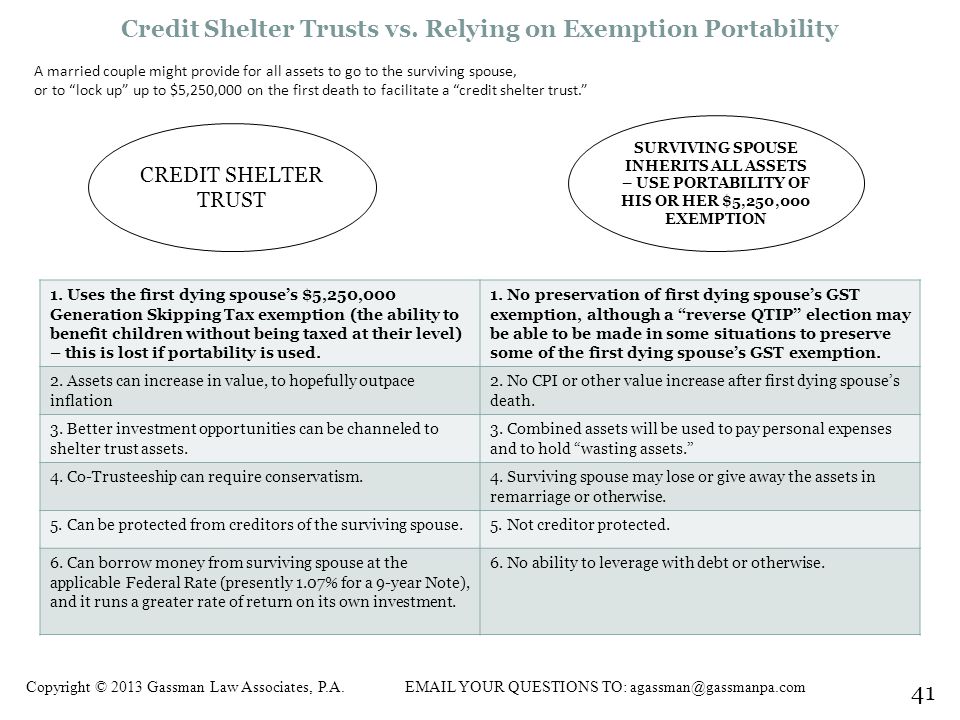

Gassman Law Associates P A Ppt Download

If the filing threshold has not been met in other words.

. The estate tax exemption for 2020 is 1158 million per decedent up from 114. However if the husbands estate had filed an estate tax return and made the election to. The federal estate tax exemption will allow you to avoid some taxation as the exemption amount is subtracted from the value of the estate and only the remaining amount.

For individuals passing away in 2017 the estate tax is the tax applicable to any amount in the decedents estate over the Federal estate tax exemption of 549 million per. But for the need to make the portability election the estate would not be required to file an estate tax return Revenue. Your unified lifetime gift and estate tax exemption in 2017 was 549 million and is now the same as the federal estate tax exemption of 12060000 per individual and 24120000 for married.

2017-34 may seek relief under Regulations section. Taxable estates that exceed. Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers.

As of 2021 the federal estate tax exemption is 114 million. In reality very few estates will pay estate tax. Her estate will owe 18 million in estate taxes 9 million less 5 million times 40.

If you have need assistance with using EFTPS contact EFTPS Tax Payment. There is no fee to use EFTPS. The 2020 increases to the estate tax exemption also impact the portability of the exclusion from a deceased spouse to their surviving spouse.

When Mark dies in 2020 his estate is still worth 20 million since he inherited 100 of the rights to the assets upon Joans death he must pass down an estate worth 20 million. How does the Federal Estate Tax Exemption work. With exemption levels being indexed for inflation the exemption.

The exemption is subtracted from the value of estate assets with the result being subject to the estate tax. Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev. The IRS increases the federal estate tax exemption each year to account for inflation.

This a good question but whether it is fair or not the federal estate tax is a fact of life. The portability of a deceased spouses unused estate tax exemption is an important concept and is even more so in 2020 which is a pivotal year in so. 6 Thus without the New York legislature intervention there is a large taxation.

In 2020 the NYS estate tax exemption amount is set at 585 Million adjusted for inflation. What Does Portability of the Estate Tax Exemption Mean. Note that when using EFTPS you will not use the table of codes listed below.

The federal tax exemption in 2020 was 114 million which leaves 86 million subject to 40 tax without portability rules. The good news is that there is a credit or exclusion that allows you to pass along a certain amount of. November 5 2020.

The exemption is in fact indexed annually for inflation so it does increase over time. The key advantage of portability is flexibility. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her.

This means that the exemption moved up to 1118 million per person for the years 2018 through 2025. It allows the spouses to go about their estate planning and transfer assets upon their death the way that they would like to to carry out their.

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group Estate And Probate Legal Group

Craftsman 1500 Watt Portable Infrared Heater The K And B Auction Company

Craftsman 1500 Watt Portable Infrared Heater The K And B Auction Company

Gassman Law Associates P A Ppt Download

Gassman Law Associates P A Ppt Download

Konig Meyer 18860 Keyboard Stands Spider Pro Actistores

If You Sell Investments You Ve Held For More Than A Year Here S What It Means For Your 2020 Tax Bill Tax Deductions Capital Gains Tax Tax Preparation

Homestead Exemptions For Seniors Fort Myers Naples Markham Norton

Can A Trust Deduct Property Taxes

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Biden Estate Tax Implications And When To Unplug Great Grandpa

What Does Portability Of The Estate And Gift Tax Exemption Mean For You Schell Bray

Locking In A Deceased Spouse S Unused Federal Estate Tax Exemption

Sioux Center Iowa Irs Tax Problems Help Pottebaum Van Bruggen Cpas

Portability Of The Estate Tax Exemption Drobny Law Offices Inc

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Portability Of The Estate Tax Exemption Drobny Law Offices Inc